receiving letter from law firm about debt collection

All too often these letters infer that if. We look forward to serving you in the future.

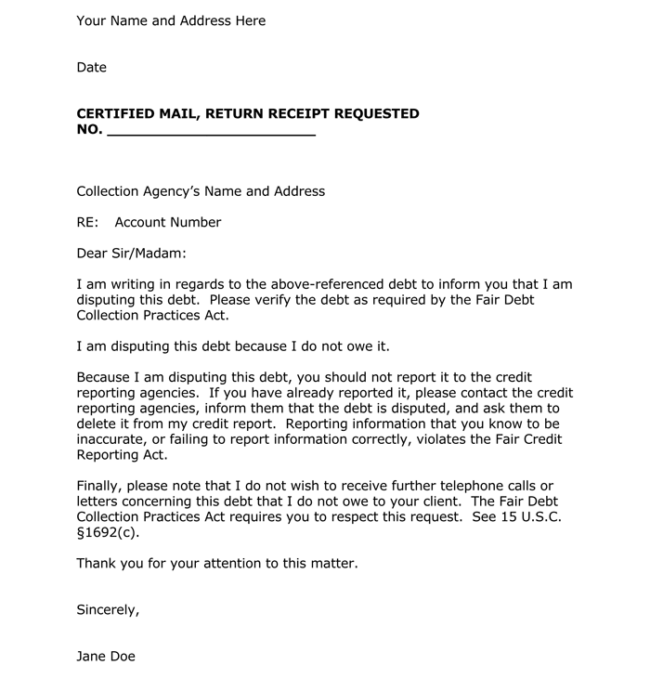

Letter Template Pay To Delete Letter 3 Brilliant Ways To Advertise Letter Template Pay To De Credit Repair Letters Letter Templates Credit Repair Business

Thank you for entrusting us to provide you with our legal services.

. Collection letters may come from attorneys or law firms in addition to collection agencies debt buyers or banks and lenders. This letter is a red flag particularly if the law firms address is in your state. Its a requirement that debt collectors send a validation letter within five days of first contacting an individual.

1234 which was credited to your account on date. Begin the letter by typing the date in the top left corner with your address below it. Under state and federal regulations debt collectors are responsible for proving the validity of a debt.

A debt collection letter is a formal notice that businessesincluding law firms give to a client who hasnt paid their bill by the agreed-upon date. Ad Book a Free Consult with Our Experienced Law Firm if Youre Being Sued for a Debt. Take advantage of the warning almost like a radar that tells you something bad is about to hit.

Leave a space then type the collectors name with his office address under it. Ad Get Access to the Largest Online Library of Legal Forms for Any State. If the offer is originally made verbally over the phone have your son ask to receive it in writing from the collection agency.

Normally the letter will also state that the debtor has 30 days to dispute the debt and gives instructions on how such a. The letter also demands payment. Begin the letter by typing the title of the issue to which you are responding.

Ultimately while this type of letter informs the borrower of their financial obligation it also serves a few additional purposes. A demand letter is also sent. Generally debts are handed to attorneys so they can take some sort of legal action.

If you fail to dispute a debt within 30 days collectorsattorneys will generally assume that it is valid. The letter will usually state that the creditor has retained the law firm in order to represent it in collecting the debt. Personal and Business Solutions.

Receiving a collection letter from a law firm can be confusing as it may lead the consumer to believe that the collection agency is pursuing some type of legal action against them. The debt collector may also offer to accept a settlement from him for a reduced amount. Demand letters can result in delinquent debtors taking the situation more seriously.

You might consider sending a validation letter to the debt collector to request legalfactual support for these charges. Keep in mind that you should always review your credit report before negotiating with a. Next you should know that many debt collection agencies send letters that say pre-litigation notice from their legal department Typically these letters are sent within five days of the first collection call you receive.

Thank You for Your Payment to Downtown Law Firm Dear client name We received your payment of XXXX on invoice No. All groups and messages. Validation letters are legally required under the FDCPA.

He should wait to make a decision whether or not to accept the offer until he receives their offer letter outlining the terms. It highlights when the payment was due and urges the debtor to clear the debt before legal action is taken. The primary purpose of the debt collection letter is to inform a debtor their payment is due formally.

You have not been sued yet. At its core a debt collection letter is a formal written request asking the borrower to resolve their outstanding debt. Check Out Our Wide Selection of Legal Forms Today.

A Demand Letter When a tenant or other customer is in default of a contractual obligation to pay you and initial efforts to collect the debt have stalled it may be time to write a strong demand letter. In other words it may be likely that youll get sued if you receive a collection letter from a law firm or an attorney. It costs money to file a lawsuit and collection firms do not want to pay it right away.

However there are a little bit more details that they need to include to qualify as a validation letter. If you owe it you may want to negotiate a lower amount. While a debt collection letter from a law firm isnt reason to panic it is something that you should take seriously.

In much the same way collection agencies may in turn seek help in collecting the debt from an attorney or law firm. This is not always the case. When someone receives a letter from a lawyer it can be frightening so there are rules the lawyer must follow in order to act as a debt collector.

In this case it is a lawsuit. This type of letter informs the recipient of their outstanding debt requests that they pay by a certain date and lets them know what will happen should they fail to pay. They would rather reach out to you and see if a payment plan can be reached.

The mail is from a San Diego law firm and right there in the envelopes address window it says ominously You may. This letter is usually a form letter that is sent out before litigation has begun. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Edelman Collection Litigation. For example the letter must be very clear that the lawyer is only helping to collect the. The next step you should take before paying a debt collector is to send a debt verification letter asking the collector to outline the debt what you owe and other information pertaining to the debt.

23 2018 3 AM PT. Follow that by informing the collector that you are writing this letter as part of you rights. As I mentioned in the previous phone call with you on the day of mention the date I am not willing to give you any amount for your debt collection.

Though it doesnt necessarily mean you are being sued the fact that the creditor andor a collection agency have engaged a law firm could indicate that they are close to filing suit. Learn More or Contact Us Today. Once your debt is assigned to a collection law firm you will typically receive a letter requesting payment of your debt.

These most likely include some of the same information as the initial debt collection letter example in the previous section. Inform debtors of an outstanding debt. A debt collection letter is sent to.

Here are the key benefits of sending a final demand letter. There is some good that comes from these letters it is like an early warning system that a collection lawsuit is coming. We are writing this letter to make you well aware that we have received your letter to collect a debt of mention the request in detail on the day of mention the date.

Generally you are given 30 days to respond and dispute the debt or point out inaccuracies. If you write back requesting proof of the obligation you are only buying time. Well Help Make Sure Creditors Follow the Law.

Ad Professional Fill in the Blanks Collections Letter Form. In most cases a debt validation letter is sent after a debtor receives a collection letter from an attorney or an agency. First and foremost it is used to remind the borrower that the debt exists.

Step by Step Instructions. Representing the Debtor Illinois Institute for Continuing Legal Education 2008 2011 2014 2019 editions as well as the chapters in Illinois Institute for Continuing Legal Education publications on the Truth in Lending Act Fair Debt Collection Practices Act Telephone Consumer Protection Act and mortgage.

Demand For Payment Letter Check More At Https Nationalgriefawarenessday Com 5696 Demand For Payment Lett Letter Templates Free Word Template Design Lettering

How To Write A Defamation Of Character Letter Inspirational Slander Letter Template Business Letter Template Formal Business Letter Lettering

Free Debt Collector Creditor Cease And Desist Letter Pdf Word Eforms

New Debt Validation Letter Sample Download Https Letterbuis Com New Debt Validation Letter Sample Download Lettering Letter Sample Letter Templates

Demand Letter Templates Free Sample Example Format Download For Payment Invoice Amount Letter Templates Simple Cover Letter Template Cover Letter Template Free

Debt Validation Letter Template Awesome Free Debt Validation Letter Template Fair Debt Collection Debt Collection Letters Credit Repair Letters Debt Collection

Printable Sample Settlement Letter Form Business Letter Template Business Letter Sample Letter Templates

Collection Agency Letter Sample Letter Requesting A Collection Agency To Validate That You Owe The Debt Collection Letter Lettering Letter Templates

Free Debt Collections Letter Template Sample Pdf Word Eforms

Free Debt Release Letter After Final Payment Pdf Word Eforms

Wage Garnishment Letter Template Debt Validation Letter Sample Creditoncreditcard Credit Repair Letters Credit Repair Companies Lettering

Sample Letter To Credit Bureau To Remove Paid Collection Regarding Charge Off Dispute Letter Template In 2022 Letter Templates Lettering Credit Repair Letters

Explore Our Example Of Charge Off Dispute Letter Template Credit Repair Letters Credit Repair Business Check Credit Score

Bad Check Collection Letter Prior To Accepting A Bad Check For Collection The Payee Must Business Letter Format Credit Repair Letters Business Letter Sample

Debt Validation Letter Template Awesome Free Debt Validation Letter Template Fair Debt Collection Debt Collection Letters Credit Repair Letters Debt Collection

Free Debt Collections Letter Template Sample Pdf Word Eforms

Debt Collection Letter Samples For Debtors Guide Tips

Free Debt Release Letter After Final Payment Pdf Word Eforms